Max Earned Income For Social Security 2025

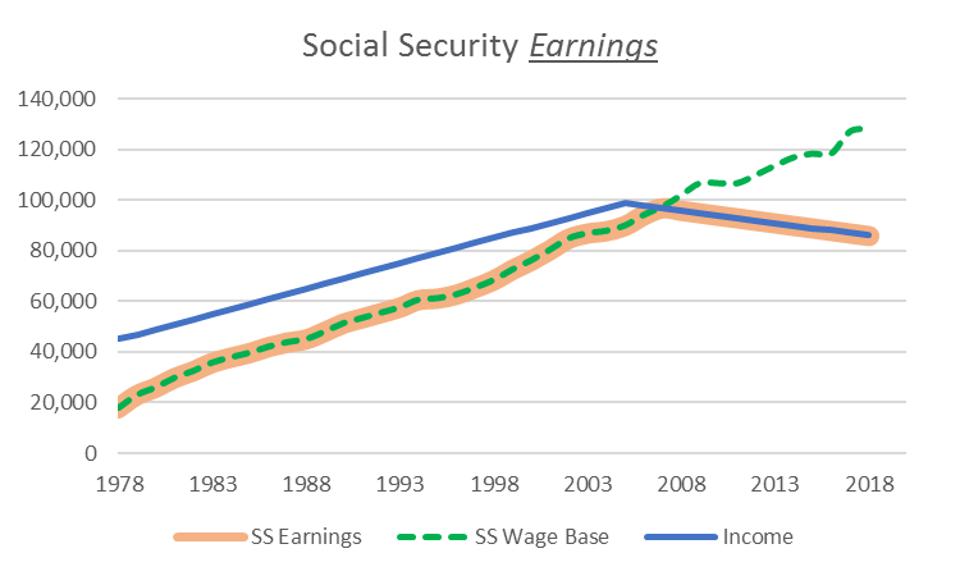

Max Earned Income For Social Security 2025. Last updated may 24, 2025 1:42 pm. The maximum earnings that are taxed have changed through the years as shown in the chart below.

This means that individuals whose earnings exceed this threshold will not pay. To claim the largest social security benefit, you have to pay the maximum amount of social security taxes for at least 35 years.

Work At Least The Full 35 Years.

What is the social security tax limit?

If You Are Working, There Is A Limit On The Amount Of Your Earnings That Is Taxed By Social Security.

This amount is known as the “maximum taxable earnings” and changes each year.

This Means That Individuals Whose Earnings Exceed This Threshold Will Not Pay.

Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

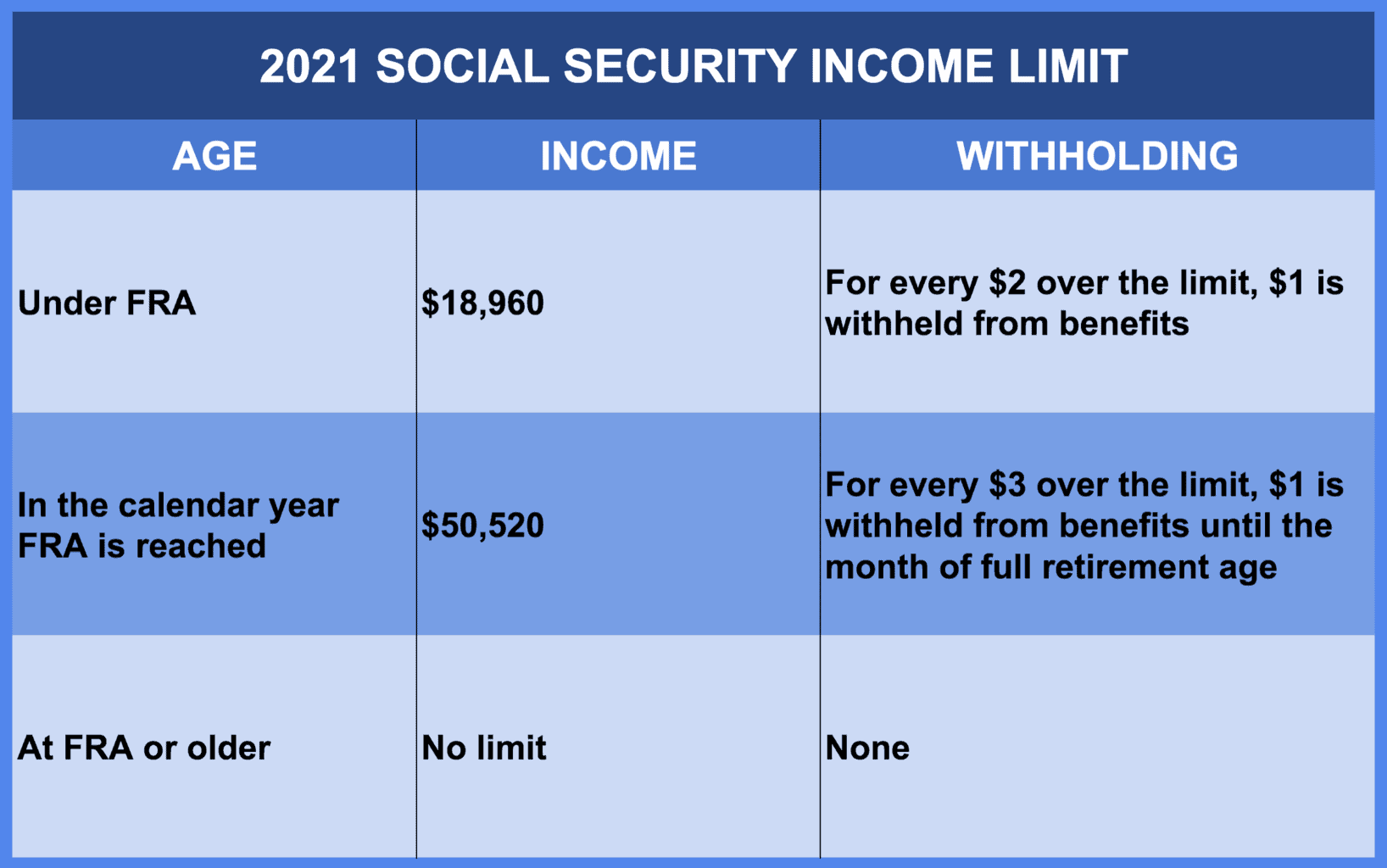

Limit For Maximum Social Security Tax 2022 Financial Samurai, If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520. The maximum social security employer contribution will increase by $520.80.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), The absolute maximum social security benefit in 2025 is $4,873 monthly, more than double the estimated average of $1,907 retirees receive across the nation as of january. The limit is $22,320 in 2025.

Source: 2022drt.blogspot.com

Source: 2022drt.blogspot.com

Social Security Maximum Taxable Earnings 2022 2022 DRT, What is the maximum social security retirement benefit payable? To claim the largest social security benefit, you have to pay the maximum amount of social security taxes for at least 35 years.

Source: mobillegends.net

Source: mobillegends.net

Social Security Wage Base 2021 And Estimation For 2022 Uzio Inc, This means that individuals whose earnings exceed this threshold will not pay. Thus, an individual with wages equal to or larger than $168,600.

Source: www.moneymatters101.com

Source: www.moneymatters101.com

Social Security Benefits Chart, If you are working, there is a limit on the amount of your earnings that is taxed by social security. Social security's formula bases benefit amounts primarily on two factors:

Source: www.sensiblefinancial.com

Source: www.sensiblefinancial.com

How Does My Affect My Social Security Retirement Benefits, This amount will be paid to. The maximum benefit depends on the age you retire.

Source: www.taxablesocialsecurity.com

Source: www.taxablesocialsecurity.com

How To Calculate Taxable Social Security 2023, If you are working, there is a limit on the amount of your earnings that is taxed by social security. Taxes on income beyond this amount.

Source: www.collinsprice.com

Source: www.collinsprice.com

2023 Social Security Disability Benefits Pay Chart, Explained by a, 50% of anything you earn over the cap. What is the social security tax limit?

Source: martynnewhalli.pages.dev

Source: martynnewhalli.pages.dev

How Much Is Ssi In 2025 Sarah Shirleen, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

Source: www.youtube.com

Source: www.youtube.com

How To Get The Maximum Social Security Benefit YouTube, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration. What is the social security tax limit?

This Amount Is Also Commonly Referred To As The Taxable Maximum.

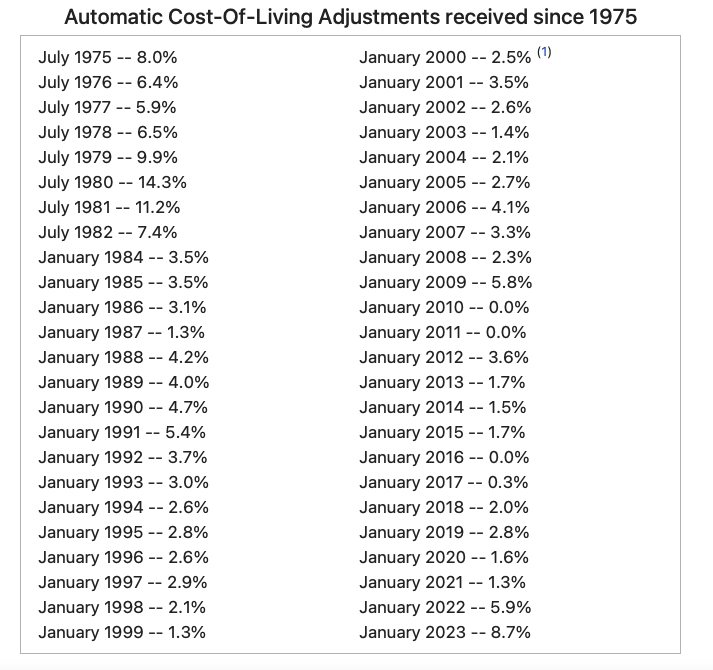

The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

The Highest Social Security Retirement Benefit For An Individual Starting Benefits In 2025 Is $4,873 Per Month, According To The Social Security Administration.

The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400).